Bitcoin ETF approvals are a pivotal moment for bitcoin. Opportunities and challenges lay ahead.

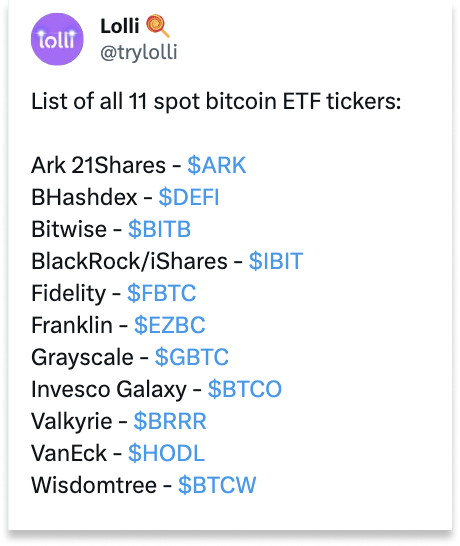

Today, 11 spot bitcoin ETFs were approved by the SEC in a historic moment for bitcoin and the financial system. These were Ark 21Shares ($ARK), BHashdex ($DEFI), Bitwise ($BITB), BlackRock/iShares ($IBIT), Fidelity ($FBTC), Franklin Templeton ($EZBC), Grayscale ($GBTC), Invesco Galaxy ($BTCO), Valkyrie ($BRRR), VanEck ($HODL), and Wisdomtree ($BTCW).

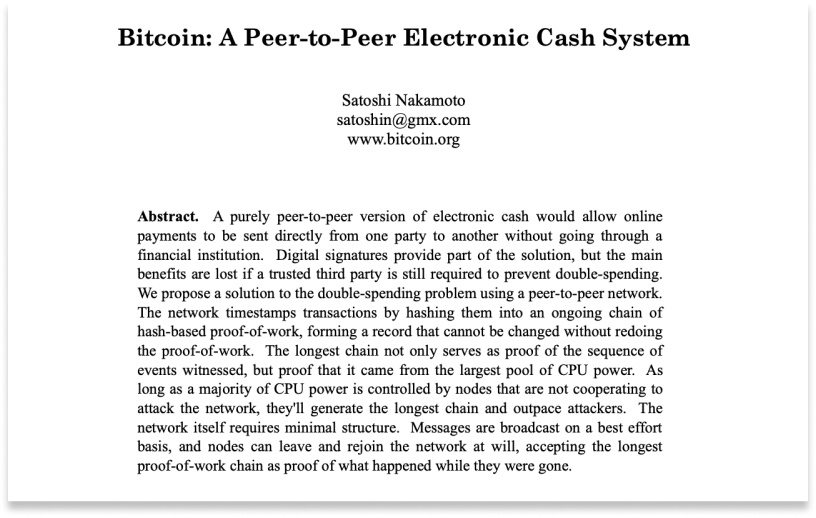

Created in 2008 by anonymous creator, Satoshi Nakamoto, bitcoin is a revolutionary currency that introduced a new financial paradigm by giving everyone equal access to sound digital money.

The approval of spot bitcoin ETFs by 11 Wall Street giants like BlackRock, Fidelity, and Invesco is a turning point in how people will learn about and gain exposure to bitcoin.

Let’s dive into what a bitcoin ETF is, and what the impact of spot bitcoin ETFs will be on the broader financial market and bitcoin itself.

What are Bitcoin ETFs?

Spot bitcoin exchange traded funds (ETFs) are investment funds that track the price of bitcoin, the world's leading and most liquid cryptocurrency. Today, with its price around $46K, bitcoin has a current market cap of roughly $900B.

Unlike traditional exchange-traded funds that invest in stocks, bonds, or commodities, spot bitcoin ETFs provide exposure to the digital currency market.

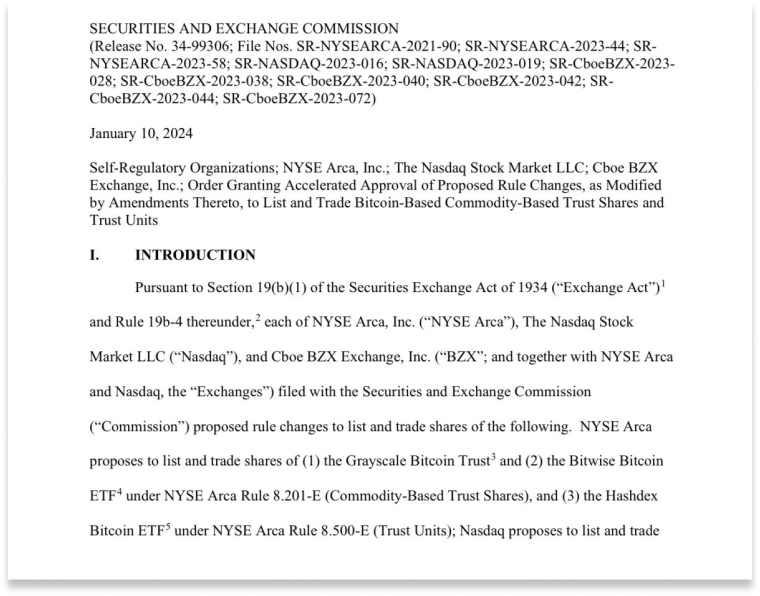

Investors can buy and sell shares of spot bitcoin ETFs on traditional stock exchanges like Nasdaq, the New York Stock Exchange, or Cboe, allowing them to gain exposure to bitcoin without directly owning bitcoin itself.

Why are Bitcoin ETFs Important?

Accessibility for Mainstream Investors

Bitcoin ETFs bridge the gap between traditional finance and the crypto ecosystem, creating an easy and familiar way for retail and institutional investors to add bitcoin exposure to their portfolios.

Any investor can buy and sell shares in an ETF at a stock market that lists them. Unlike buying bitcoin, buying shares in an ETF doesn’t require people to navigate cryptocurrency exchanges, store their bitcoin, or undertake any of the responsibilities involved when you custody your own bitcoin.

Regulatory Approval and Oversight

Bitcoin ETFs now operate within the regulatory framework of traditional financial markets, subject to the oversight of the Securities and Exchange Commission.

This regulatory approval adds a layer of legitimacy and a sense of safety to cryptocurrency for institutional and retail investors, attracting those who may have been hesitant to enter the space due to regulatory uncertainties.

Added Liquidity

Bitcoin ETFs have been long anticipated in the bitcoin community for their expected positive impact on bitcoin’s price. By allowing more investors to participate in bitcoin through ETFs, the bitcoin market may experience increased demand and trading volumes, driving bitcoin’s price up.

Increased mainstream bitcoin adoption may also lead to decreased volatility, paving the way for a more mature and stable bitcoin market over time. With strong, stable prices for bitcoin, we will likely see further adoption and acceptance by institutional investors and the general public.

What are the potential pitfalls of a Bitcoin ETF?

Increased Centralization

Bitcoin was created to operate as a decentralized, peer-to-peer digital currency, allowing anyone to directly buy and own their own bitcoin without the need for a third-party intermediary like a bank or asset manager.

Bitcoin ETFs introduce a new level of centralization that goes against bitcoin’s core value proposition. By relying on third-party custodians and intermediaries, bitcoin ETFs introduce counterparty risk, as users depend on these entities, and thereby contradicts bitcoin’s original mission and ethos.

Regulatory Dependence

While regulation can provide positive momentum for mainstream adoption, it can also pose a potential risk of excessive external control.

Bitcoin is a permissionless, borderless, decentralized currency. Regulatory control over bitcoin introduces the potential for regulators to attempt to exert undue control over the currency.

Price Manipulation Risks

Bitcoin ETFs on the market already have participation from powerful institutional players like J.P. Morgan and Jane Street. With the entry of these capital-intensive firms, there is a risk of market manipulation that can occur by shorting bitcoin through ETFs. This opens the door to potential price manipulation that contradicts bitcoin’s ethos of creating a fair and transparent market for everyone and taking power away from Wall Street.

Spot bitcoin ETF approvals are a tremendous step forward for mainstream adoption of bitcoin. However, bitcoin ETFs do not replace or emulate owning your own bitcoin in any way. The only way to benefit from bitcoin as a revolutionary technology that allows anyone in the world to own their own money without relying on a intermediary is to do just that - to own your own bitcoin.

Since 2018, Lolli has been giving everyone an easy way to earn and own bitcoin, just by shopping with the free browser extension, site, or mobile app.

Download Lolli today to earn and own your own bitcoin.