The Bitcoin Halving is coming soon. Here's why it matters and what you need to know.

The Bitcoin Halving is nearly here. This pivotal event in bitcoin is a turning point in the bitcoin ecosystem, significantly affecting miner profitability and market dynamics and auguring far-reaching consequences for bitcoin and crypto.

Scheduled to occur roughly every 210,000 blocks - which typically takes four years - the next Bitcoin Halving is scheduled to take place on Friday, April 19th. Here's what you need to know to be ready to understand this milestone.

Plus, remember to earn bitcoin with Lolli today and after the Halving. Bitcoin's price historically grows after the Halving - we'll get more into that soon.

What is the Bitcoin Halving?

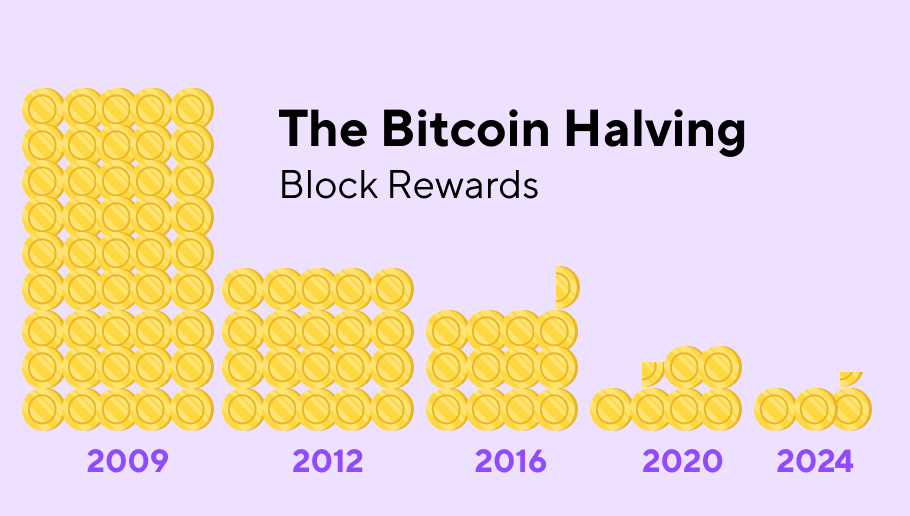

New bitcoins enter the circulating supply through a process called mining. Miners validate transactions and add them to the blockchain to secure and maintain the network, and for each block they add, they receive an incentive reward in bitcoin. Currently, that reward is just around 6 bitcoins for each block added to the blockchain.

To ensure a controlled and predictable supply of Bitcoin, Satoshi Nakamoto, Bitcoin's creator, programmed the reward for reward for mining new blocks to be cut in half approximately every four years, or after every 210,000 blocks are mined. This event is aptly named the "Bitcoin halving."

Why Does It Matter?

Supply and Demand Dynamics

With the issuance rate of new Bitcoins cut in half, the circulating supply decreases. Basic economic principles dictate that when the supply diminishes while demand remains constant or increases, the value tends to rise. This scarcity factor often leads to a surge in Bitcoin's price over time, and bitcoin has historically hit new all time highs aligned in the months following a Halving.

Note that bitcoin's total supply of 21 million bitcoins will never change - the Halving only affects the amount of bitcoin in current circulation. We'll see our last Halving around 2040, when bitcoin is scheduled to reach its full circulating supply of 21 million bitcoins.

Mining Economics

For miners, the halving event directly impacts their profitability and is perhaps the most significant disruptive force in the mining sector.

Since the reward for mining a block is reduced, miners must adapt their strategies to maintain profitability. This may involve upgrading hardware, optimizing energy efficiency, or even relocating operations to regions with lower energy costs.

Market Sentiment

The Bitcoin halving generates excitement and speculation within the bitcoin and crypto community and beyond.

Historically, previous halving events have been associated with significant price rallies. This anticipation often drives investor sentiment and market dynamics leading up to and following the event.

This year, Bitcoin ETFs provide a new factor that could influence how market sentiment around the Halving influences price. Bitcoin ETFs have seen billions in daily inflows, with leaders like BlackRock's iShares ETF $IBIT breaking records as the top performing ETF launch in 30 years.

By providing an accessible entry point to mainstream investors, giving them a way to gain exposure to bitcoin through a familiar financial vehicle, momentum around the Halving could lead to significant price surges.

What Can We Expect Next?

While you never know what to expect with bitcoin and past performance doesn't indicate future results, historical data can provide some insights into potential outcomes following the Halving.

Price Volatility

In the immediate aftermath of the halving, bitcoin's price may experience heightened volatility as market participants speculate on the news. Sharp fluctuations, both upward and downward are not uncommon during this period.

Long-Term Appreciation

Despite short-term fluctuations, supply-demand dynamics point to a long-term appreciation in bitcoin's price following the Halving. Factors like growing adoption and institutional interest in cryptocurrencies will also contribute to bitcoin's ongoing upward trajectory, building on momentums year-to-date momentum up roughly 50%.

Increased Attention

Media attention surrounding the Halving often leads to increased mainstream interest in crypto and bitcoin. This can lead to higher trading volumes, expanded user adoption, and a broader discussion about the role of digital assets in the global economy.

We're celebrating the Halving at Lolli with exclusive giveaways and more. Follow Lolli on X and Farcaster, and join the Discord to stay up to date and win free bitcoin.