In 2008, Bitcoin's pseudonymous creator, Satoshi Nakamoto, published the Bitcoin Whitepaper, creating a revolutionary new monetary system and transformative possibilities for finance, commerce, and the world.

As the Bitcoin Whitepaper marks its 15th birthday, we are celebrating by reflecting on the revolutionary solutions laid out in the pivotal document by its author, Satoshi Nakamoto.

At just 9 pages long, the technical manifesto lays out bitcoin’s mission, its functional mechanisms, and how it achieves goals achieved by no electronic cash project before it, including a way to process secure transactions without the need for a trusted third party like a bank.

The world since 2008...

When Satoshi Nakamoto published the Bitcoin Whitepaper in 2008, the world was in many ways similar to the one we live in today. The economy had just plunged into a financial crisis, people’s trust in the systems presiding over them had been shaken, and new technology proposed a vision of a new and better world.

And yet, much has happened in 15 years since the publication of the Whitepaper.

Bitcoin is now owned by over 200 million+ people globally and widely used as a currency and store of value, especially where rampant inflation makes bitcoin better, more secure money than fiat currency.

Bitcoin has also been embraced by leading global financial institutions like BlackRock, Fidelity, and Bank of New York Mellon – and spawned a multi-billion dollar financial industry in itself.

And yet, with all that has changed since the Bitcoin Whitepaper’s publication so many years ago, the key tenets of bitcoin – what it aims to solve and its unique ability to solve them – have remained the same.

Read on as we outline 3 critical problems with the legacy financial system and other attempts at digital currencies that bitcoin fixes, as laid out in the Whitepaper.

The Weakness of the Trust-Based Model

Among the core problems that bitcoin solves is that of the trust-based financial model.

The traditional financial system relies almost entirely on trusted third-party intermediaries like banks and payment processors to process transactions and ensure that they remain secure and accurate. However, this trust comes at a price. It introduces costly mediation for parties on either side of a transaction and increases potential for fraud. It also means, as Satoshi wrote, that “the fate of the entire money system depends on a company running the mint, with every transaction having to go through them.”

Bitcoin eliminates the need for trust-based financial systems by creating a system that runs entirely on cryptographic proof, making the flow of money more secure and less costly. As Satoshi prescribed in the Whitepaper, “what is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.”

And so Satoshi created just that, with bitcoin.

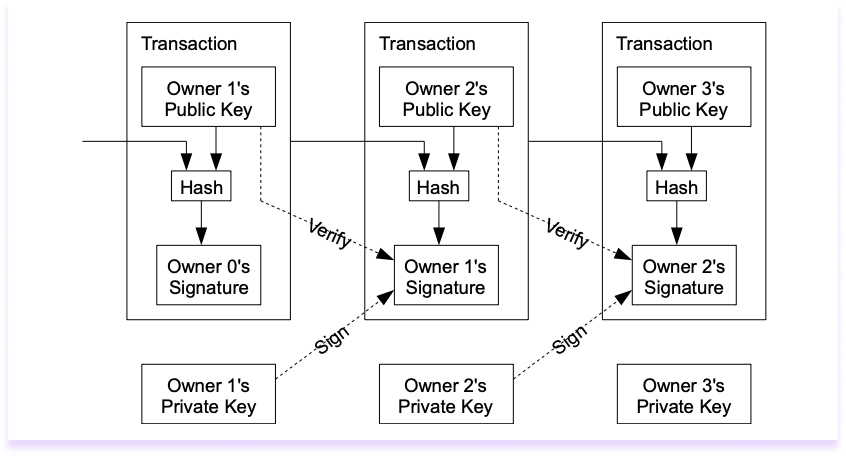

Now, imagine you want to make sure that when you send digital money to someone, that the transaction gets there, safe and sound.

Instead of financial institutions ensuring that your transaction gets where it needs to go, bitcoin creates a new paradigm for monetary transactions: a decentralized network of nodes that is incentivized to accurately and efficiently process ongoing transactions through a system called ‘proof of work’.

What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.

The proof of work system has run without fail for 15 years to produce bitcoin transactions every 7 - 10 seconds, creating the largest global financial system that is completely independent of a government, or mediating party like a bank.

Double-Spending Problem

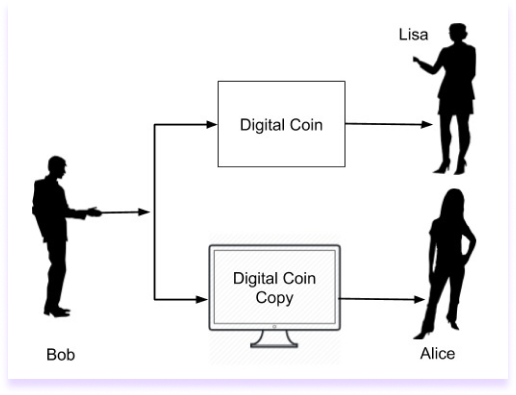

Ah, the double spending problem. In creating a digital currency, the most formidable challenge has been eliminating the risk of double spending, where a user can spend the same digital coin multiple times, effectively gaming the system. In fact, multiple digital currencies existed before bitcoin that failed to solve the double-spending problem, like Digicash and E-gold.

Traditional currencies rely on a central authority to prevent the issue of digital spending, and bitcoin proposes a unique solution based on a distributed timestamp server and proof-of-work.

Bitcoin was the first cryptocurrency to effectively address the double spending problem, primarily through a combination of proof of work and the use of a blockchain, which provides a public ledger of all transactions on bitcoin.

When someone wants to spend their bitcoin, their transaction is broadcast to all the computers in the network, so that each computer checks if the transaction is valid. To add a transaction to the blockchain, miners compete to solve that really hard math puzzle – once added, it’s pretty much impossible to change past transactions. If an attacker wanted to do this, it would have to redo the work for that block and all the blocks following it, which is prohibitively hard and would require a massive and extremely expensive amount of computing power.

As transactions are documented on the bitcoin blockchain in a chronological order that is computationally impractical to alter, it effectively eliminates the double-spending problem. Voilà.

Privacy Concerns

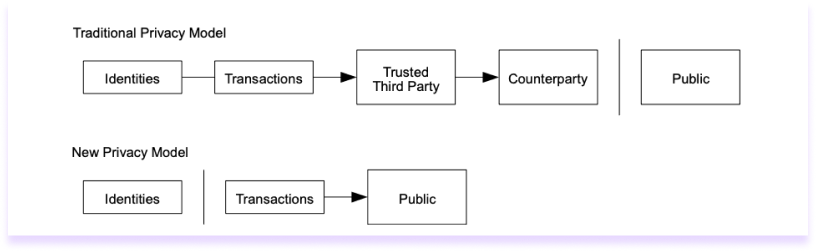

As Satoshi wrote, "the traditional banking model achieves a level of privacy by limiting access to transaction information to the parties involved and the trusted third party." However, traditional banking still gathers a tremendous amount of personal information that can be hacked and exploited by any bad actor that infiltrates the network that these intermediaries rely upon.

In contrast, bitcoin allows its users to maintain privacy and pseudonymity when making transactions. The information recorded on the blockchain for any given bitcoin transaction is limited to the transactor’s public address, the amount transacted, and a timestamp. That’s all.

This information is publicly available to anyone who wants to view the blockchain at any time, making it a fully transparent and public ledger that maintains the privacy of those using it.

As Satoshi notes in the Whitepaper, this is “similar to the level of information released by stock exchanges, where the time and size of individual trades, the 'tape', is made public, but without telling who the parties were."

Satoshi Nakamoto's Bitcoin Whitepaper revolutionized digital finance by creating a system that eliminated trust-based financial models, solved the double-spending problem, and preserved user privacy. You can read the full Whitepaper here!

Today, you can celebrate by earning bitcoin rewards with Lolli at 25,000+ stores like CVS, Booking.com, Macy's, and more.

Sign up for free today and link a card to start earning bitcoin rewards on everything you buy. Plus, get $5 in free bitcoin when you share your referral code with a friend and they earn for the first time.

Happy Birthday, Bitcoin Whitepaper! 🎉